Case Studies

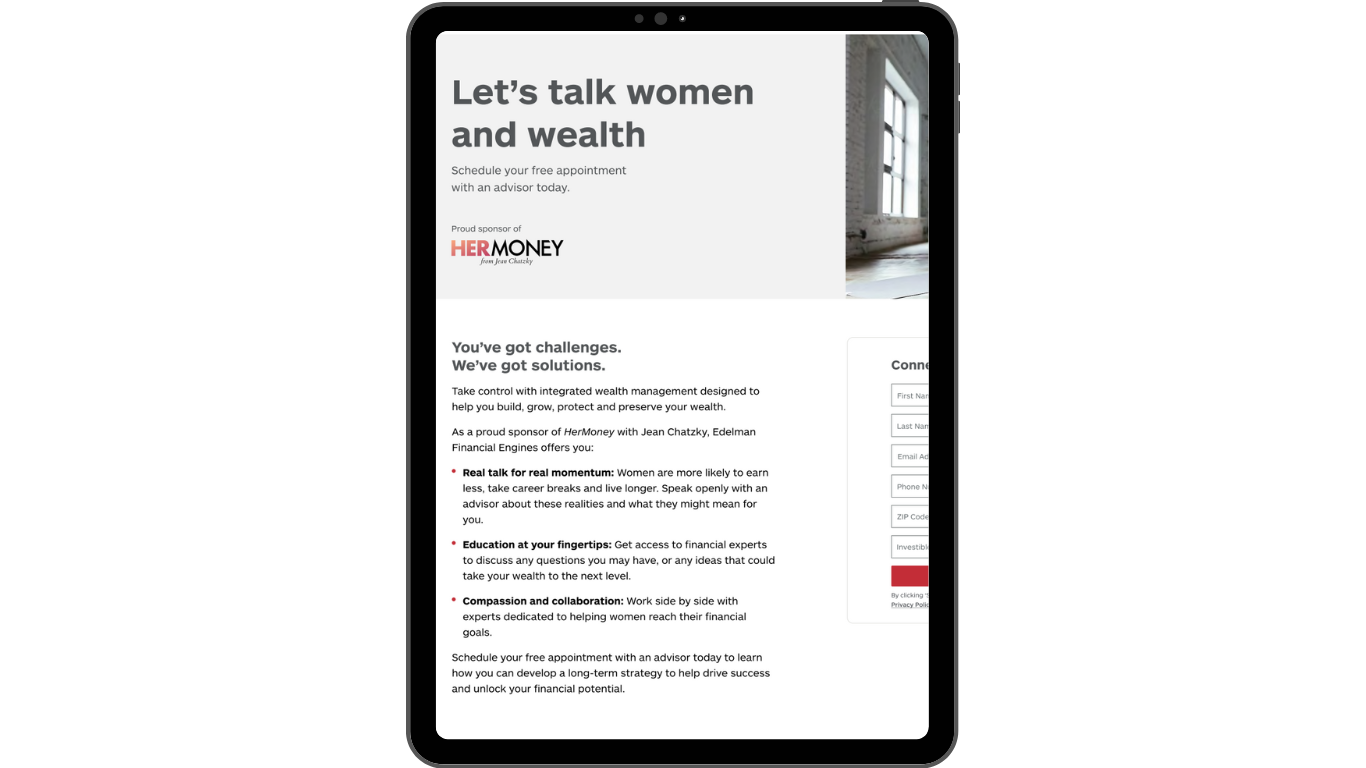

Empowering Women in Wealth

Initiative: Partner with HerMoney, a podcast hosted by award-winning journalist and financial expert Jean Chatzky, to promote our services and how they can help women gain more confidence in their financial planning.

Initiative:

- Partner with HerMoney, a podcast hosted by award-winning journalist and financial expert Jean Chatzky, to promote our services and how they can help women gain more confidence in their financial planning.

Challenges:

- Our audience will be driven to this landing page via promotion during episodes of the HerMoney podcast, as well as on the HerMoney website. How do we honor the tone and teachings of Jean Chatzky while embracing our own voice and tone?

- How do we connect this initiative to the promotion of our own podcast, Everyday Wealth?

Solutions:

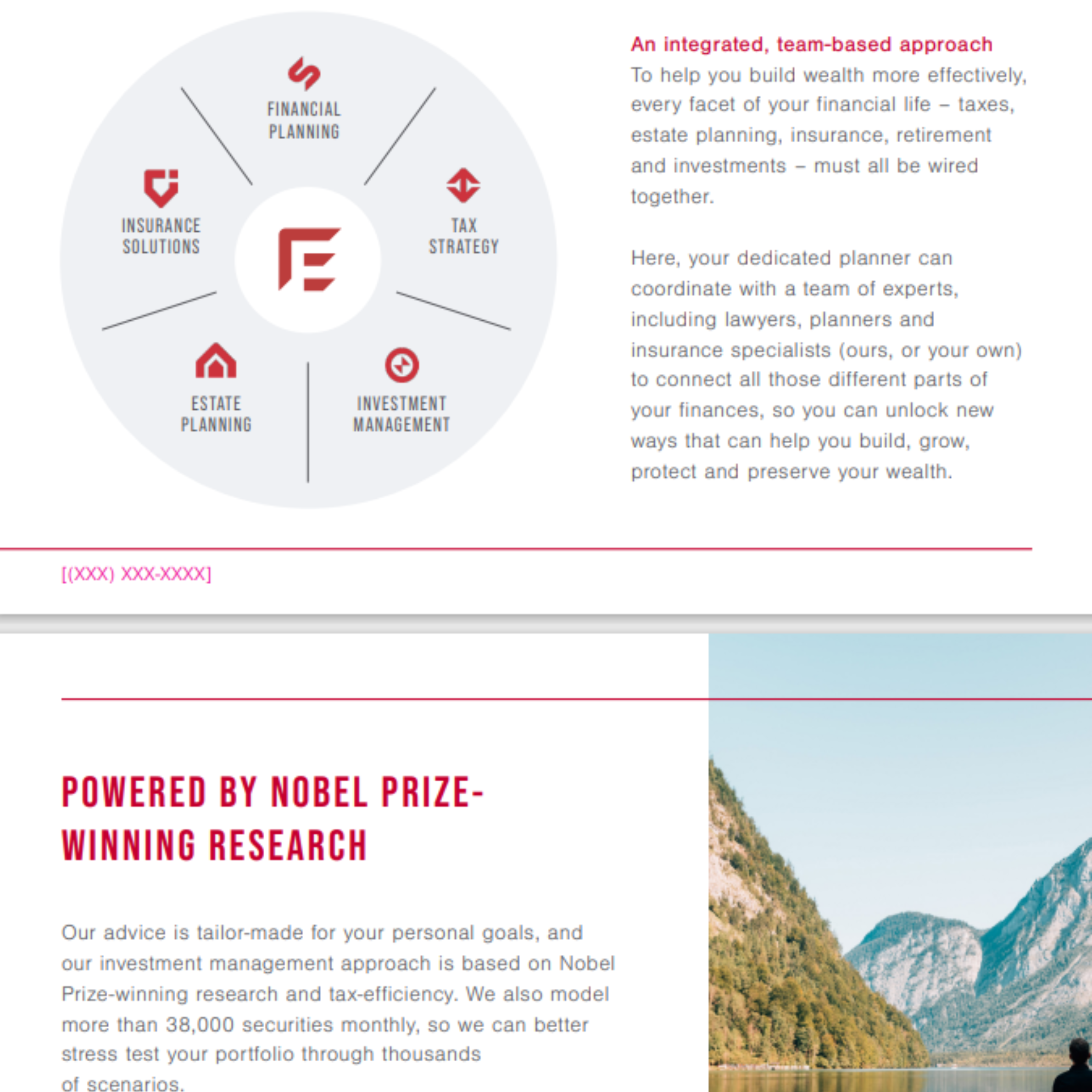

- Create a landing page that can become a hub for women to learn more about our services in a safe, welcoming environment tailored to their unique needs.

- Since much of this audience would be driven to this landing page after listening to the HerMoney podcast, we surmised that many of them enjoy learning about finance through podcasts. To capitalize on this, we used a small banner to showcase our own podcast (hosted by two prominent women in the financial industry). This would increase listenership by offering our audience yet another way to engage with us when they want and how they want.

Execution:

- Describing our services in a value-forward approach. Speaking directly to the specific concerns women encounter in financial planning – such as career breaks, wage discrepancy, and more.