Case Studies

Retirement Advice Services Promotion

Initiative: Revamp a massive campaign that brings in $7-8B in assets under management (AUM) each year in order to re-engage participants and get them more involved in their financial planning.

Initiative:

- Revamp a massive campaign that brings in $7-8B in assets under management (AUM) each year in order to re-engage participants and get them more involved in their financial planning.

Challenges:

- This campaign’s success had been consistently declining over 10 years. How do we strategically reinvent this campaign to increase enrollments and participation?

- Working closely with an external creative agency to build and oversee every piece of this project – from conception, to creation, to deployment.

- How do we make our message – the importance of retirement planning – resonate with all audiences, regardless of age, acumen, or assets?

Solutions:

- Work collaboratively with key marketing stakeholders, client research teams, consumer insights teams, and creative groups to build a comprehensive strategy with:

- More specific audience segmentation:

- “New Savers” – Younger audience focused on financial fundamentals.

- “Accumulators” – Middle-aged audience trying to manage their increasingly complex financial lives.

- “Seasoned Savers” – Older audience focused on getting ready for retirement.

- A trigger-based communications journey with stronger, more targeted content.

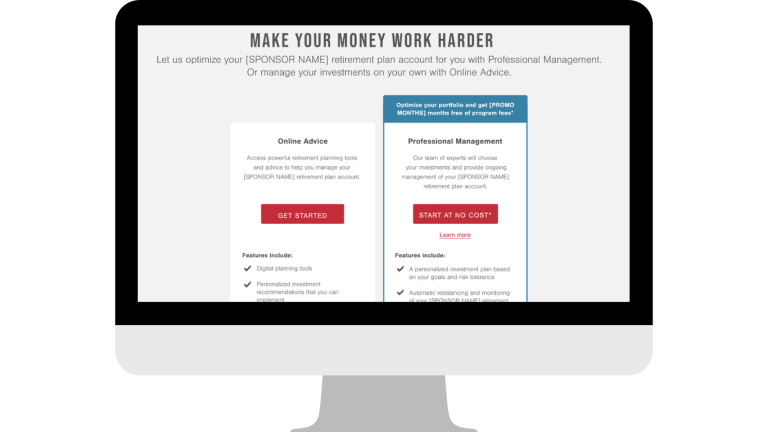

- Updated brand messaging and design.

- More specific audience segmentation:

- Brief a new creative agency on the nuances of our services and how we speak about them externally, as well as our brand expression and guidelines. Then work closely with this agency to write and review all deliverables.

- After intense research (consisting of live forums, polls, and participant surveys) we got to the heart of each segment’s most common financial needs, goals, and worries. We then tailored all copy and design toward those segments to elicit higher engagement.

Execution:

- Employing the concept of “Don’t Just Hope for the Best”

- Concept Manifesto: Sometimes in life, It can feel like you’re just trying to keep up. Other times, you wish it would just slow down. You worry about your financial future, But you might feel like you don’t have time to plan for it. So you put it off. You hope for the best. You hope you’ll afford that house. You hope the college funds will be enough. You hope your savings will last through retirement. It’s time to get past wishful thinking. It’s time to plan for the future you want, so you can spend more time enjoying the here and now. And we can help.

- Threading this concept into all deliverables while altering language, messaging, and imagery to target each audience’s core needs, worries, and aspirations.