Case Studies

Retirement Counseling Service

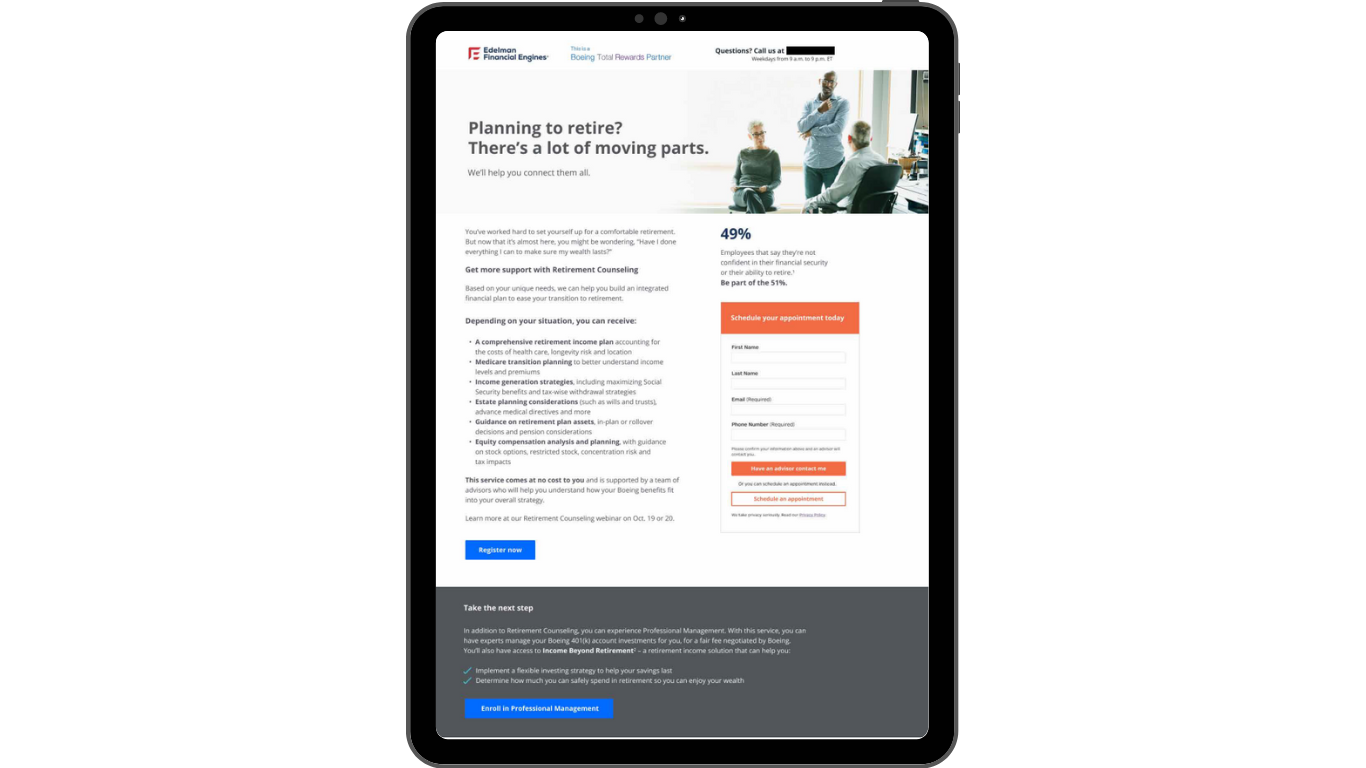

Initiative: Re-introduce a service available exclusively for Boeing employees who are approaching retirement (ages 55+, in all asset classes).

Initiative:

- One year after the initial launch of the Retirement Counseling service, we wanted to remind Boeing employees of its value and how it can help them gain confidence in their financial future – all while updating the campaign to embrace our evolving brand voice, tone, and design.

Challenges:

- We’ve already advertised this service. How do we connect with our participants on an emotional level to

make this promotion different? - Our re-brand had not officially launched yet, but we still wanted to elevate our deliverables past our current

brand. How do we capture the essence of the new brand while avoiding official “new-brand” materials such

as logos, fonts, and colors? - How do we ensure the print deliverables look exactly like our designed pieces?

Solution:

- Deploy a combination of direct mail, email, landing pages, website banners, and LinkedIn ads showing

participants that we understand the unique point they’re at in their lives. We know how they feel – worried,

questioning, hopeful. We care about their fears and aspirations. And we offer advice to help each individual

reach their retirement goals. - Rely on strong, concise copy that fully embraces our new voice, tone, and messaging to subtly showcase

our new brand without utilizing unauthorized design elements. - Collaborate with an external print studio to understand dimensions and print capabilities to ensure a clean final product.

Execution:

- Leaning into the near-retiree mindset of, “Am I missing something in my retirement planning and financial

strategy?” - Designing the brochure to incorporate a die-cut in the shape of our logo – inferring that the missing piece

in their financial plan is us. - Using language to express the importance of integrated financial planning. We’ll be able to help participants connect major pieces of their retirement plans (taxes, Social Security, Medicare, employee benefits, ect.) so they can walk into retirement fully prepared to live – and sustain – the life they want.